Full Charge Bookkeeping Guide to Financial Management

Before they can practice professionally, full charge bookkeepers are required to obtain certification from a recognized institution. US institutions that can provide these include the American Institute of Professional Bookkeepers, the National Association of Certified Public Bookkeepers, and other educational or career institutions. They demand different requirements, but one of the basics is previous professional experience and passing an exam.

- By maintaining accurate records of these transactions, you ensure that all expenses are properly recorded and accounted for.

- Even though the income of full-charge bookkeepers is not as competent as that of accountants or taxation experts, they earn quite more than a regular bookkeeper.

- A full charge bookkeeper plays a vital role in ensuring that your financial statements are prepared accurately and in a timely manner.

- US institutions that can provide these include the American Institute of Professional Bookkeepers, the National Association of Certified Public Bookkeepers, and other educational or career institutions.

Case Studies: Successful Full Charge Bookkeeping in Action

While education lays the foundation, gaining practical experience is crucial for becoming a successful full charge bookkeeper. Practical experience allows you to apply your knowledge in real-world scenarios and develop the necessary skills to handle the of the role effectively. Running a business involves juggling various responsibilities, and bookkeeping can be time-consuming and complex. By hiring a full charge bookkeeper, you can free up valuable time and resources to focus on your core business functions. Instead of spending hours on bookkeeping tasks, you can dedicate your energy to growing your business, serving your customers, and developing new strategies.

Advantages of Outsourcing Full-Charge Bookkeeping

Generally speaking, accountants analyze the financial data gathered by bookkeepers. What is the full charge bookkeeper’s role in comparison to an accountant’s, then? Although FC bookkeepers do provide accounting services, they usually don’t act as financial advisors or deal with auditing and tax reports. Full charge bookkeepers usually seek external assistance from a certified public accountant or a controller. The full-charge bookkeeper is often regarded as the financial backbone of an organization.

Responsibilities of a Full Charge Bookkeeper

Building a strong network within the accounting and bookkeeping community can also open doors to new job opportunities and career advancement. However, as your business appetites grow and your company scales, you might ask yourself whether this role should be taken to a higher level as well. ” question and explain the job’s duties, responsibilities, educational requirements, and more. Small business owners are typically experts in their field or industry but might need more financial expertise to keep their company’s books in order.

- In addition to managing accounts receivable, full charge bookkeepers are responsible for handling accounts payable.

- They maintain complete and up-to-date detailed accounts and manage all the fundamental bookkeeping duties, such as ledger entries, financial statement preparations, and payroll.

- In summary, a full charge bookkeeper is a highly skilled and essential member of any organization.

- A full charge bookkeeper and a regular bookkeeper may seem similar at first glance, but they have distinct differences in terms of their scope of work.

- With the right combination of education, experience, and skills, individuals can position themselves as valuable assets to businesses seeking comprehensive accounting support.

- With limited resources, they often need help handling accounting in-house or seeking external support.

- Supervising the accounting staff of pen-pushers is also their responsibility along with contacting relevant professionals working exteriorly for your company such as a certified public accountant (CPA).

- Consider attaining certifications such as Certified Bookkeeper (CB) or QuickBooks Certifications.

- If they work as an independent contractor they usually earn more for their services.

- Although it seemed like something anyone could do at the beginning, over time, it can get more complicated and even time-consuming.

- The full charge bookkeeper is literally in charge of the accounting department offering a direct line to money matters for the C-suite.

Embarking on the transition requires a readiness to handle a wider array of bookkeeping and accounting responsibilities. This includes managing everything from day-to-day financial transactions to preparing detailed financial statements and overseeing tax preparations. Full charge bookkeeping is a financial service that encompasses the complete range of accounting tasks for a business.

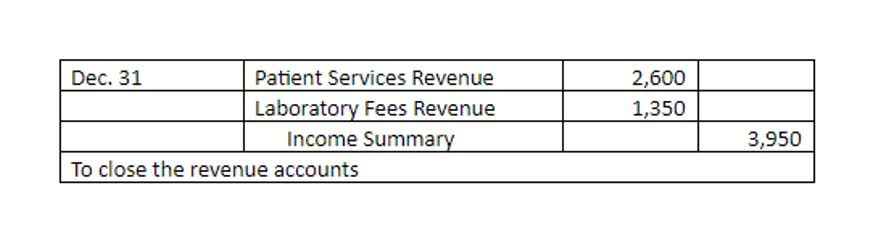

Preparing Financial Statements and Tax Returns

By delegating these tasks to a professional, you can ensure that your financial records are accurate and up to date while focusing on the areas of your business where you can make the most impact. Full-charge bookkeeping is an all-encompassing financial management approach https://www.bookstime.com/articles/bookkeeping-seattle that involves meticulously recording, organizing, and reporting an organization’s financial transactions. Unlike regular bookkeeping, which may focus on specific tasks like data entry or maintaining ledgers, full-charge bookkeeping entails a broader set of responsibilities.

Outsourced bookkeeping services can provide your business with expertise without the overheads of hiring an in-house bookkeeper. It’s a cost-effective solution for small businesses or those experiencing rapid growth. And while a full-charge bookkeeper will eventually supervise these roles, you’ll need to make sure you’re appropriately staffed to fill the void this promotion leaves behind.

- To navigate these waters successfully, developing robust financial strategies is essential.

- Full-charge bookkeeping entails everything that regular bookkeeping does.

- Adding a full-charge staff member means you may need to examine your internal bookkeeping needs and hiring goals.

- These duties include managing accounts receivable, handling accounts payable, reconciling bank statements, and generating financial statements.

- Unfortunately, the drawback of other versions, such as the disadvantages of QuickBooks Online cannot be neglected, particularly in the case of large business companies.

- It is essential to have a keen eye for detail to ensure that every entry is accurate and properly recorded.

- Due to their extensive expertise, experienced bookkeepers are typically more expensive than ordinary ones, making it challenging for small businesses to afford them right from the start.

Handling accounts payable includes tasks such as verifying invoices, obtaining necessary approvals for payment, and scheduling payments to meet deadlines. It is crucial to have a systematic approach to managing accounts payable to avoid late payment penalties and maintain positive relationships with suppliers. Employing a full charge bookkeeper is like adding a seasoned navigator to your crew, bringing what does full charge bookkeeper mean a wealth of benefits that ensure your financial management sails smoothly toward success. Bringing full-charge bookkeepers on board isn’t as simple as hiring them. Their skills need to be integrated effectively into your existing bookkeeping processes. Career growth will solely rely on your interests in this industry, growth progress and the number of years of experience invested in it.

Reconciling Bank Statements

A full charge bookkeeper takes full responsibility for managing all financial transactions, maintaining accurate records, and providing detailed reports to business owners and leadership teams. This role goes beyond traditional bookkeeping duties by overseeing the entire accounting cycle from start to finish. By outsourcing bookkeeping services, businesses can free up valuable time and resources that can be redirected towards core functions. Instead of spending hours managing financial records, business owners can focus on strategic planning, sales, and customer relationship management. This shift allows for better resource allocation and can ultimately contribute to the growth and success of the business. With their attention to detail and expertise in accounting software, full charge bookkeepers can generate comprehensive financial reports that provide valuable insights into your company’s financial health.